click to enlarge

Tag Archives: vendor management

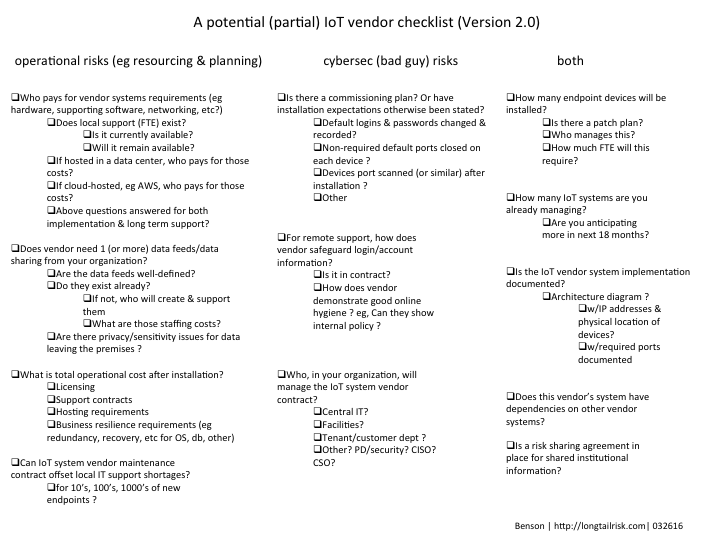

A potential IoT systems vendor checklist v2.0

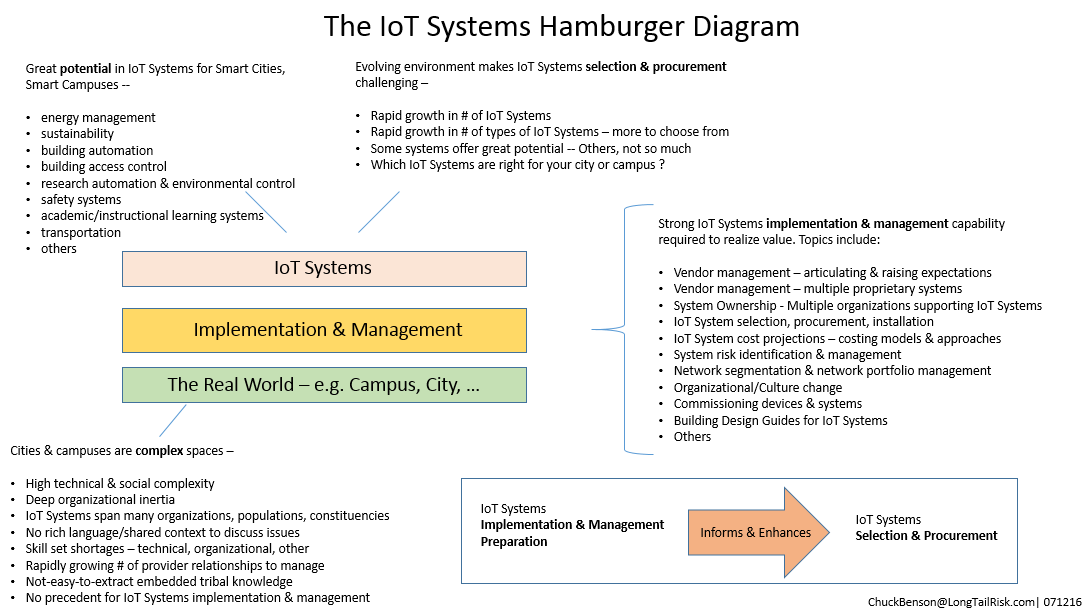

In order to maximize the value of an IoT system to an institution or city, how that system is implemented is critical. Without a thoughtful and thorough implementation, the value of the investment will not be met and, possibly, the value can even be negative through the addition of unmitigated risk to the institution or city.

I’ve updated the IoT systems planning considerations list from an earlier post and created a more checklist-like document to use when working with IoT systems vendors. Earlier versions appeared in posts Institutional considerations for managing risk around IoT, Developing an IoT vendor strategy, and Systems in the seam – shortcomings in IoT systems implementation. Ideally, this document could be used during the contract development and negotiation phases with the vendor.

The intent of the document is to help compute the Total Cost of Ownership for an IoT systems implementation as well as raise expectations of the vendor for a delivered system. In doing so, we can help mitigate some operational risk (suboptimal business decisions) as well as cybersecurity-related risk (bad guys wanting to use our assets in a malicious manner).

I’ve created rough categorizes of issues falling under operational risk, cybersecurity risk, and those falling in both categories to help provide some additional structure. However, many issues influence each other so it’s not critical to get tied up in the categorization.

A starting point for an IoT systems vendor checklist

pdf version here

Developing an IoT vendor strategy

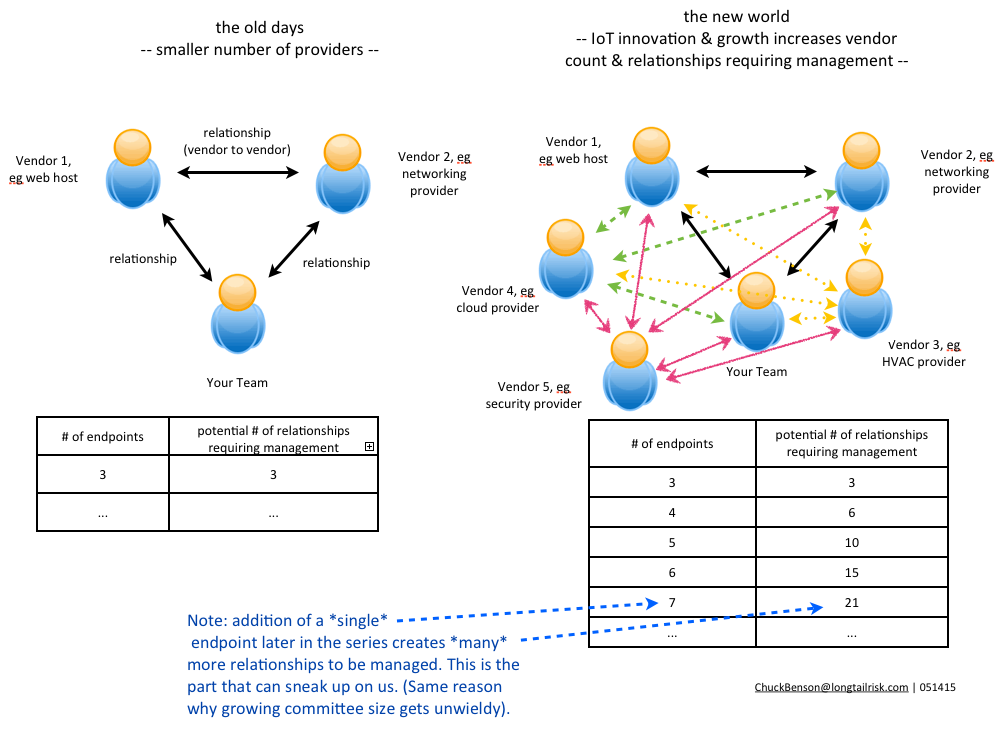

The vendor count for IoT systems that a company or organization manages will only increase in the coming months and years and it will possibly increase substantially. Some of this will be from traditional systems like HVAC that have been in the space longer than most and are maturing and extending their IoT development and deployment. New growth in an organizations’s vendor count will be from vendors with brand new products and service lines made possible by IoT innovation and expansion. Many of the benefits of IoT will be from products and services from different vendors that interact and exchange information with each other such as an IoT implementation leveraging the cloud. Regardless of the source, the number of IoT vendors that an organization has will grow.

This increased IoT system vendor count is not a bad thing in its own right. However, a somewhat insidious effect is that the number of relationships to be managed (or not managed) will grow even faster than the increasing vendor count itself.

Relationships have friction

Every relationship has friction or loss from an idealized state. Nature has plenty of examples — pressure loss in a pipe, channel capacity in information theory, marriage, and heat engine efficiency established nearly 200 years ago by Sadi Carnot. Carl Von Clausewitz famously established the concept of friction in war in his book On War in which he sometimes evokes the image of two wrestlers in a relationship.

Relationships between business customer and their vendors have friction too — from day-to-day relationship management overhead such as communication planning and contract management to more challenging aspects such as expectation alignment/misalignment and resource allocation problems.

Friction in a business customer-vendor relationship (unavoidable to some degree) means less information gets communicated than expected, similar to Shannon’s observations on information exchange. And similar to limits expressed with Carnot’s engine efficiency, less work gets done in practice than in the idealized state. Particularly for the former, a reduction in expected information exchange, by definition, increases uncertainty. Further, friction in a network of relationships can manifest itself in yet even more uncertainty. Less work gets done than is expected and the state of things is unclear.

With a growing network of nodes (IoT vendors in this case), the even faster growing number of relationships, and the friction that naturally exists between them, our business environments are becoming increasingly complex and accompanied with increased uncertainty. Vendor management and its associated risk, in the traditional sense, have left the building.

Sans organizational IoT strategy, IoT vendors will naturally optimize for themselves

While a strategy around IoT deployment and IoT vendor management can be difficult to devise and establish given the complexity and relative newness of the phenomenon, we have to acknowledge that vendors/providers will naturally optimize for themselves if we don’t have an IoT implementation strategy for our organizations.

This is not an easy thing. We really don’t know what is going to happen next in IoT innovation, so how do we establish strategy? Also, the strategy might cost something in terms of technical framework and staffing — and that is particularly hard to sell internally. However, without some form of an IoT system implementation strategy, each individual provider will offer a product or service line implementation that’s best for them. They won’t be managing the greater good of our organization. This is not evil, it’s natural in our market economy — but we as business consumers need to be aware of this.

Similar to the concept of building a socket in the last post, in establishing a policy or framework for IoT vendor relationships, some IoT vendor considerations might include:

- Are there standard frameworks that can be deployed to support requirements from multiple different IoT vendors? For example, does every vendor need their own dedicated, staffed, and managed database? If individual vendors demand dedicated support frameworks/infrastructure, are they willing to pay for it or otherwise subsidize it?

- Does your vendor offer a VM (virtual machine) image that works in your data center or with your cloud provider? Do they offer a service that helps integrate their VM image into your data center or cloud environment?

- Are there protocols that can be leveraged across multiple different vendors? Does the vendor in consideration participate in open-source protocols? For example, for managing trust, Trusted Computing Group has extended some of their efforts in an open source trust platform to the IoT space.

- Does the vendor provide a mechanism to help you manage them for performance? If so, the vendor acknowledges the additional complexity that managing many IoT systems brings and offers to help you review and manage performance.

While an IoT framework or policy at this stage is almost guaranteed to be imperfect, incomplete, and ephemeral, the cost of not having one puts your organization at every IoT system provider’s whim. And that cost is probably much higher.

Use Heartbleed response to help profile your vendor relationships

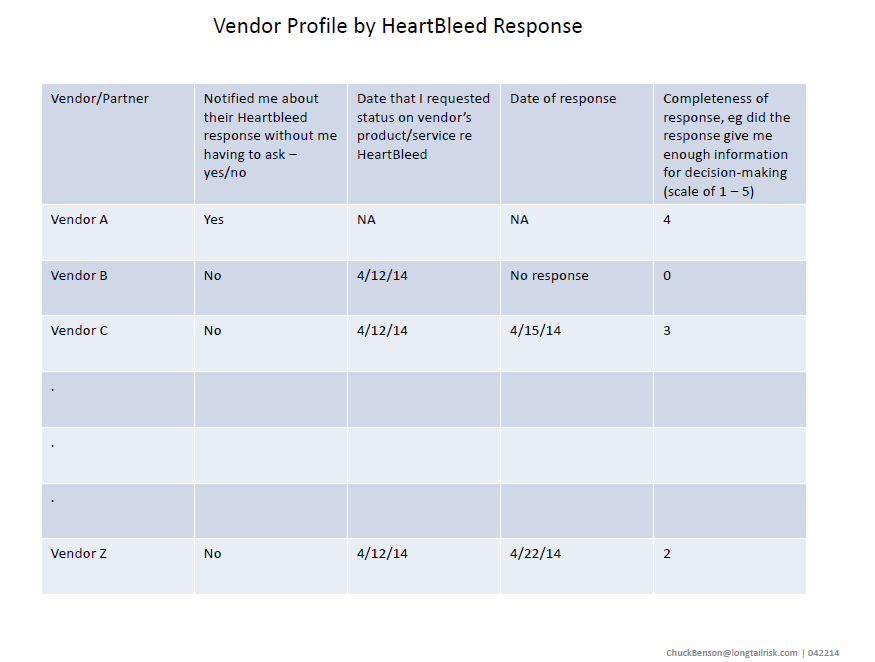

To paraphrase REM, whether Heartbleed is the end of the world as we know it (11 on a scale of 10) or if we feel fine (or at least not much different), how our vendors respond or don’t respond gives us the opportunity to learn a little more about our relationship with them.

I’ve only seen one unsolicited vendor response that proactively addressed the Heartbleed discovery. In effect, the email said that they (the vendor) knew there was a newly identified vulnerability, they analyzed the risk for their particular product, took action on their analysis, and communicated the effort to their customers. This was great. But it was only one vendor.

Other vendors responded to questions that I had, but I had to reach out to them. And from some vendors, it has been crickets (whether there was an explicit Heartbleed vulnerability in their product/service or not).

Ostensibly, when we purchase a vendor’s product or service, we partner with them. They provide a critical asset or service and often an ongoing maintenance contract along with that product/service. The picture that we typically have in our heads is that we are partners; that we’re in it together. Generally, that’s also how the vendor wants us to feel about it.

What does it mean then, if we have little or no communication from our ‘partner’ when a major vulnerability such as Heartbleed is announced? Where this is the case, the partner concept breaks down. And if it breaks down here, where else might it break down?

Because of this, we can use the Heartbleed event to provide a mechanism to revisit how we view our vendor relationships. A simple table that documents vendor response to Heartbleed could give us broader and deeper perspective into understanding our vendor relationships.

For this example, because of their quick communication that did not require me to reach out, I might send a thank you email to Vendor A to further tighten that relationship . Vendor C and Vendor Z are in the same ball park, but I might want to follow up on the delay. I’ll definitely be keeping Vendor B’s complete lack of response in mind the next time the sales guy calls.

Again, some vendor responses might be great. However, I think vendor and partner relationships aren’t as tight as we may like to tell ourselves and we can use vendor customer response to Heartbleed as an opportunity to reflect on that.

[Heartbleed image/logo: Creative Commons]

Some Heartbleed vendor notifications from SANS