In this age where scale is king and where government sanctioned pension default, where executive compensation and line worker pay disparities continue to grow, and where willingness to shed trust for a few moments of attention, among others exist, what does trust mean to us? Is there a limit to how large a business can grow and still be trusted, both internally (employee to business) and externally (business to customer)?

Many, if not most, of our information systems rely on trust. Prime examples are banking systems, healthcare systems, and Industrial Control Systems (ICS). We expect banking and healthcare systems to have technical protections in place to keep our information from ‘getting out’. We expect that the people who operate these systems won’t reveal our data or the secrets and mechanisms that protect them.

Similarly, critical infrastructure ICS, such as power generation and distribution systems, must deliver essential services to the public, government, and businesses. To prevent misuse, whether ignorance or malicious intent, it must do so without revealing to all how it is done. Again, we expect there to be sufficient protective technologies in place and trusted people who, in turn, protect these systems.

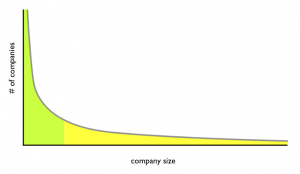

The problem is that I’m not sure that trust scales at the same rate as other aspects of the business.

British anthropologist Robin Dunbar’s research suggests that the maximum number of stable relationships a person can maintain is in the ball park of 150. After that number, the ability to recognize faces, trust others in the organization, and other attributes of a stable group begin to roll off.

Exacerbating this numerical analysis are the recent phenomena mentioned above of pension defaults, unprecedented compensation disparities, and selling trust for attention. We don’t trust our employers like we used to. That idealized 1950’s corporate loyalty image is simply not there.

No data centers for trust

So as critical information systems such as healthcare, banking, and ICS seek to scale to optimize efficiency for profit margins and their systems require trust and the required trust doesn’t scale with them, what does that mean?

It means there is a gap. There are no data centers for trust amongst people. The popular business model implies that trust scales as the business scales, but trust doesn’t scale that way, and then we’re surprised when things go awry.

I think it’s reasonable to assert that in an environment of diminishing trust in business and corporations (society today), that the likelihood goes up of one or more constituents violating that trust and possibly disclosing data or the secrets of the mechanisms that protect that data.

Can we fix it?

I don’t think so. It’s a pleasant thought and it’s tidy math, but it’s just that — pleasant and tidy and not real. However, the next best thing is to recognize and acknowledge this. Recognize and plan for the fact that the average trust level across 100 large businesses is probably measurably less than the average trust level across 100 small businesses.

With globalization and mingling of nationalities in a single business entity, there is talk of misplaced loyalties as a source of “insider threat” or other trust leakage or violation. That may be, but I don’t know that it’s worse than the changes in perception of loyalty in any one country stemming from changes in trust perception over the past couple of decades.

So what do we do — Resilience

It gets back to resilience. If we scale beyond a certain point, we’re going to incur more risk — so plan for it. Set aside resources to respond to data breach costs, reputation damage, and other unpleasantness. Or plan to stop scaling fairly early on. Businesses that choose this route are probably fairly atypical, but not unheard of.

We can’t control what happens to us, but we can plan for a little more arbitrariness and a few more surprises. This doesn’t mean the check is in the mail, but it increases the likelihood that our business can make it to another day.